Global Policy Shifts

Plastic waste is one of the most pressing environmental challenges of our time—today, over 11 million tonnes enter oceans annually, projected to rise to 29 million tonnes by 2040 if unchecked. This crisis demands not just technological solutions but systemic change—and that’s where policy steps in. Regulatory frameworks, economic incentives, and international agreements are reshaping how we design, manage, and recycle plastics.

This article explores how policy shifts worldwide are fueling innovation across recycling technologies, business models, and market systems. Whether you’re a student exploring circular economy principles, a professional in sustainable packaging, or a researcher studying regulatory impacts—you’ll find insights grounded in the latest data and global examples.

The Current State of Plastics Recycling

Global Plastic Waste Statistics and Challenges

Plastic production has skyrocketed over the last few decades, surpassing 460 million tonnes annually worldwide, with demand still growing in packaging, automotive, healthcare, and electronics. Yet recycling systems have not kept pace. Globally, only about 9–12% of plastics are successfully recycled, while the rest is landfilled, incinerated, or leaked into the environment. Much of this plastic waste ends up polluting oceans, rivers, and soils, creating long-term ecological and health risks.

The core challenge lies in the linear plastics economy—a “take, make, dispose” model that prioritizes cheap virgin plastics over circular solutions. Unlike metals or glass, plastics degrade in quality when recycled, a phenomenon known as downcycling, which limits their reuse. Infrastructure gaps in collection, sorting, and processing further exacerbate the problem, particularly in low- and middle-income countries where waste management systems remain underdeveloped.

Why Recycling Rates Remain Low Despite Growing Awareness

Even with increasing consumer awareness of the plastic pollution crisis, global recycling rates remain stubbornly low. Several key barriers explain this trend:

- Insufficient sorting technology: Traditional mechanical sorting systems struggle with multi-layered packaging, black plastics, and mixed polymer streams. This leads to high contamination rates that render large volumes unrecyclable.

- Weak economic incentives: Virgin plastic, derived from fossil fuels, is often cheaper than recycled alternatives due to subsidies and volatile oil prices. This discourages manufacturers from using post-consumer recycled (PCR) content.

- Contamination and quality issues: Food residues, additives, and colorants lower the purity of recyclates, making them less desirable for high-value applications like food-grade packaging.

- Fragmented regulations and infrastructure: While the European Union has ambitious recycling targets, many regions lack harmonized policies or modern facilities—resulting in inconsistent performance across the globe.

Ultimately, without stronger policy support and market demand, recyclates struggle to compete with virgin plastic in both quality and price.

Traditional vs. Advanced Recycling Methods

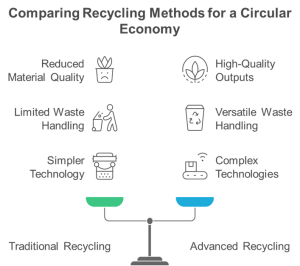

Plastics recycling methods fall broadly into two categories: mechanical recycling and advanced (or chemical) recycling.

Traditional Mechanical Recycling

It involves collecting, shredding, washing, and remelting plastics. This method works well for clean, single-polymer waste streams such as PET bottles or HDPE containers. However, mechanical recycling typically reduces material quality due to thermal degradation and contamination—limiting the number of times plastics can be recycled before becoming waste.

Advanced Recycling Technologies

These technologies are emerging to address these limitations. These include:

- Chemical recycling processes such as pyrolysis (breaking plastics into oil), gasification, depolymerization (returning polymers like PET to monomers), and solvent-based purification. These methods can handle mixed or contaminated plastics and produce outputs nearly equivalent to virgin materials.

- Enzymatic recycling uses bioengineered enzymes to break down polymers like PET into monomers under mild conditions. This approach offers potential for high-purity, circular recycling of complex plastic streams.

- AI-driven and digital-enabled sorting leverages robotics, hyperspectral imaging, and machine learning to improve waste separation, reduce contamination, and increase throughput in material recovery facilities (MRFs).

By combining mechanical and advanced approaches, the recycling industry is moving toward a closed-loop or circular plastics economy, where plastics are continuously reused without losing performance.

Policy Shifts Transforming the Plastics Recycling Landscape

International Agreements and Frameworks

The Global Plastic Pollution Treaty was expected to establish a legally binding framework by the end of 2024, targeting plastic production, waste reduction, and circular economy integration. However, as of mid-2025, negotiations remain stalled. A key sticking point lies in the divide between petrochemical-producing nations, which resist strict production caps, and more ambitious countries pushing for aggressive targets on waste reduction and recyclability.

Despite the slow progress, the treaty discussions have already sparked global awareness and encouraged many nations to align their plastic waste policies with circular economy principles.

Regional and National Plastic Waste Policies

European Union: EPR and the Circular Economy Action Plan

The European Union remains at the forefront of recycling policy. Through the Circular Economy Action Plan, the EU has set binding targets for plastic packaging, including minimum recycled content requirements and strict Extended Producer Responsibility (EPR) frameworks. These measures compel producers to design packaging that is easier to recycle, invest in recyclate markets, and ensure greater accountability for post-consumer plastic waste. This policy direction not only boosts demand for post-consumer recycled (PCR) materials but also fuels innovation in packaging design and waste collection systems.

United States: State-Level Policies

In the United States, the absence of a federal recycling mandate has shifted responsibility to individual states. Some have introduced plastic bag bans, bottle bills, and recycled content laws, while others remain reliant on voluntary industry initiatives. Notably, U.S. reclaimers have more than doubled their capacity to supply PCR materials between 2021 and 2025, signaling progress. However, weak nationwide collection systems and inconsistent recycling infrastructure continue to limit material recovery rates, highlighting the need for uniform national recycling standards.

Asia-Pacific: China’s Waste Import Ban

China’s “Operation National Sword”, launched in 2018, restricted the import of contaminated plastic waste and sent shockwaves through the global recycling market. By shutting its doors to foreign waste, China forced many developed nations to confront their dependence on exporting recyclables. This ban accelerated investment in domestic recycling infrastructure, particularly in Southeast Asia, Europe, and North America, and sparked growth in chemical recycling technologies to handle mixed and hard-to-recycle plastics. The ripple effects continue to shape global waste trade policies today.

Emerging Economies

Emerging economies are increasingly active in reshaping recycling systems through EPR-driven policies and public–private partnerships. In India, Shakti Plastic Industries has partnered with LyondellBasell to establish a 50,000-tonne mechanical recycling facility, demonstrating how industry collaboration can expand capacity under EPR frameworks. Meanwhile, in Ireland, the launch of a Deposit Return Scheme (DRS) in February 2024 transformed plastic bottle recovery rates, pushing recycling from 49% to an impressive 91% by July 2025.

These examples highlight how policy, when combined with innovation and industry engagement, can rapidly accelerate recycling progress in both developed and developing regions.

Extended Producer Responsibility (EPR) as a Game

What Is EPR and How It Works

Extended Producer Responsibility (EPR) is a policy approach that shifts the financial and operational responsibility for managing plastic waste from governments and taxpayers to the producers who put plastics on the market. Under EPR, companies are required to cover the costs of collection, sorting, recycling, and disposal, which creates a strong incentive to reduce waste at the source. By tying financial responsibility to environmental impact, EPR encourages producers to design packaging for recyclability, invest in sustainable materials, and support infrastructure development that closes the loop on plastics.

Global Examples of EPR in Plastics Recycling

Countries across the world are adopting EPR frameworks to strengthen recycling systems:

- Ireland: The introduction of a Deposit Return Scheme (DRS) under EPR has significantly reduced plastic litter while boosting collection rates. Within its first year, Ireland’s DRS improved recovery of PET bottles and aluminum cans, ensuring cleaner recycling streams.

- Developing countries: Global policy discussions suggest that a portion—around 10% of EPR fees paid by producers in the Global North—should be directed to help build waste management infrastructure in developing regions. This approach addresses global equity challenges and ensures that recycling improvements are not limited to high-income countries.

- European Union: Many EU states now mandate that plastic packaging meet minimum recycled content requirements under EPR, directly driving demand for post-consumer recycled (PCR) plastics.

How EPR Encourages Innovation in Design and Materials

Beyond compliance, EPR drives product and material innovation. Companies are motivated by both financial and reputational factors to explore alternative materials that reduce regulatory risks. For instance, Xampla, a Cambridge-based materials company, has raised $14 million to scale plant-protein-based packaging. These biodegradable films and coatings are exempt from the EU’s single-use plastics restrictions, positioning them as a next-generation sustainable packaging solution. Similarly, many global brands are redesigning their packaging to be mono-material, easier to recycle, or made from bio-based and compostable plastics—all responses accelerated by EPR requirements.

By linking corporate responsibility to environmental outcomes, EPR policies are transforming plastics recycling from a cost center into a driver of innovation, investment, and sustainability.

The Rise of Circular Economy Policies

Defining Circular Economy in Plastics Recycling

A circular economy ensures materials remain in use—minimizing waste. For plastics, this means reusable packaging, high-quality recyclates, and design for disassembly.

Case Studies: EU, Japan, South Korea

France’s anti-waste and circular economy law targets 100% plastics recycling by 2025 and bans single-use items while outlawing misleading “biodegradable” claims.

Retail initiatives like Tesco in the UK set goals to make all own-brand packaging recyclable by 2025, cutting waste and piloting reusable models.

Circular Business Models Enabled by Policy Incentives

Supermarkets in Australia—through a revived scheme from Soft Plastics Stewardship—are now collecting soft plastics in-store again after REDcycle collapsed.

Green Taxation, Subsidies, and Financial Incentives

Plastic Taxes on Virgin Materials

Policies taxing virgin plastics raise recycling competitiveness, though details vary by jurisdiction.

Subsidies for Recycled Plastics and Bio-based Alternatives

Programs supporting recycled or bio-based plastic use—such as EU incentives—are enabling new material entrants like seaweed or plant-based films.

Carbon Credits and Green Financing Driving Innovation

Case studies reveal that policy-backed ecosystems stimulate private investment—unlocking trillions in public and private finance for plastics circularity.

Bans, Restrictions, and Consumer Behavior Shifts

Single-Use Plastic Bans and Their Impact on Recycling Demand

South Australia banned fish-shaped soy-sauce containers in September 2025, reducing litter and prompting shifts toward reusable alternatives.

How Policy Shapes Consumer Awareness and Recycling Habits

In France, banning disposable items and simplifying recycling messaging helps consumers take eco-friendly actions effortlessly.

Plastic Bag Levies and Deposit Return Schemes

Ireland’s DRS effectively reduced bottle and can litter—beach surveys found counts fell from around 100 to just 8 per km.

Technological Innovation Driven by Policy

Mechanical Recycling Upgrades (AI-driven sorting, robotics)

AI-driven sorting dramatically improves efficiency—startups like AMP Robotics show how smart automation can reduce contamination and improve recovery.

Chemical Recycling (pyrolysis, depolymerization, solvent-based recycling)

Resynergi uses microwave-powered pyrolysis to turn stubborn plastics into oil—but faces local opposition despite meeting air standards. LyondellBasell repurposed a former refinery in Houston to chemical recycling, raising community and transparency concerns.

Enzymatic and Biotechnological Recycling Solutions

At IIT-Bhilai, researchers developed a nano zero-valent iron catalyst to depolymerize PET back to its monomer (BHET) under mild conditions—enabling high-quality circular recycling.

Digital Tracking and Blockchain for Plastic Waste Management

Traceability and blockchain are emerging as essential tools for transparent plastic reverse logistics and investor confidence.

The Role of Public–Private Partnerships in Policy Implementation

How Governments and Corporations Collaborate on Recycling Goals

Successful programs—like Australia’s new soft-plastics scheme—are co-managed by regulators, supermarkets, and brand partners.

NGOs as Policy Influencers

Advocacy groups push for stronger treaty frameworks and highlight failed or problematic projects—like Danone’s aborted waste-to-energy attempt in Bali, which highlighted the need for binding global plastic agreements.

Startups and Academia Driving Innovation Under Policy Frameworks

IIT-Bhilai’s PET depolymerization research and Xampla’s plant-based packaging innovations thrive under supportive research funding and regulatory incentives.

Measuring the Success of Policy Interventions

Recycling Rate Improvements and Global Benchmarks

Ireland’s DRS demonstrates how policy can elevate recycling from under 50% to over 90% in under two years.

Lifecycle Assessments and Environmental Impact Metrics

Plastic collection data—like reduced ocean-bound waste in South Australia and DRS-driven litter drops—quantify policy impact for stakeholders.

Economic Benefits of Policy-Driven Recycling Systems

Reports highlight increased U.S. investment capacity: plastics equipment imports rose in 2025, signaling industry confidence. Shipments of plastics machinery also rose, demonstrating growth despite trade uncertainty.

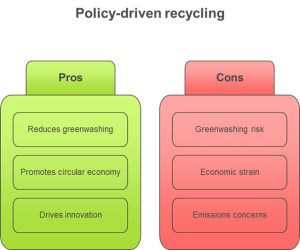

Challenges and Criticisms of Policy-Driven Recycling

Risk of Greenwashing and Loopholes

France’s law combats greenwashing by banning terms like “biodegradable” when scientifically unsupported.

Economic Burdens on Small Businesses and Developing Nations

EPR fees can strain smaller producers; proposals for fee-sharing and global solidarity aim to ease the burden.

The Debate Between Mechanical vs. Chemical Recycling Policies

While advanced recycling holds promise, communities worry about emissions—as seen with Resynergi and LyondellBasell facilities.

Future Outlook: Policy Directions for the Next Decade

Global Policy Harmonization and Trade Implications

Efforts toward a Global Plastic Treaty continue—but dramatic geopolitical negotiation gaps point to slower progress ahead.

Integration of AI, IoT, and Smart Infrastructure in Policy Frameworks

Policymakers are likely to mandate digital traceability, AI-driven sorting systems, and recycled content labeling in upcoming regulations.

Vision 2030 and Beyond: Towards a Plastic Circular Economy

Countries like France aim for 100% plastics recycling by 2025 and elimination of single-use packaging by 2040. Investments approaching $1.2 trillion may be needed by 2040 to achieve plastics circularity at scale.

FAQs on Policy Shifts and Plastics Recycling

What policies have the biggest impact on plastics recycling?

Extended Producer Responsibility (EPR), deposit-return schemes (DRS), single-use bans, and circular economy laws consistently drive higher recycling rates and recyclate use.

How do extended producer responsibility (EPR) schemes benefit recycling innovation?

EPR creates financial accountability for producers, prompting eco-design and funding for infrastructure. In Ireland, DRS under EPR doubled bottle return rates to 91% by mid-2025.

Why did China’s plastic waste import ban change global recycling?

China’s “Operation National Sword” eliminated imports of contaminated recyclables, forcing Western exporters to innovate recycling infrastructure and sorting technology.

Are chemical recycling technologies supported by government policies?

Yes and no. While policies are increasingly open to advanced recycling, community backlash and regulatory gaps highlight a need for stronger safeguards.

What role do consumers play in policy-driven recycling success?

Consumers respond to convenient, clear policies—like soft-plastics return bins in supermarkets or reusable packaging initiatives. Behavior change is essential, especially when coupled with supportive infrastructure.

Will global plastic treaty negotiations create standardized recycling policies?

Negotiations are ongoing but have stalled as of mid-2025. A legally binding global treaty remains the goal, but consensus gaps between nations are slowing progress.

How do subsidies and tax incentives encourage the use of recycled plastics?

By making recycled content more cost-competitive, incentivizing circular product design, and supporting bio-based alternatives—these financial levers spur investment and commercial adoption.

Conclusion

Policy shifts—from EPR schemes and deposit-return systems to bans and advanced recycling mandates—are the linchpin of plastics recycling innovation. We’ve seen these tools raise recycling rates, drive technological breakthroughs, and open financing pathways. Yet challenges persist: policy harmonization, avoiding greenwashing, ensuring equity, and building public trust. The path forward requires collaboration across governments, industry, academia, and civil society. As we look to 2030 and beyond, robust, transparent policies are our roadmap to a true circular economy—where plastics become perpetual resources, not persistent waste.

Read More on Plastics….

Resources:

Policy Shifts in Plastics Recycling