Global Green Hydrogen Market 2025

Green hydrogen—produced through the electrolysis of water using renewable energy sources such as wind, solar, or hydropower—has emerged as one of the most promising solutions in the global clean energy transition. Unlike grey hydrogen, which relies on fossil fuels, or blue hydrogen, which requires carbon capture, green hydrogen is entirely carbon-free, making it a cornerstone technology for decarbonizing hard-to-abate sectors like heavy industry, transportation, and chemicals.

By 2025, the green hydrogen market has entered a decisive growth phase, with billions of dollars in investments, gigawatt-scale projects under construction, and national hydrogen strategies being rolled out across multiple regions.

Updated and reliable market statistics are now more critical than ever for students, professionals, researchers, and policymakers seeking to understand the trajectory of this transformative industry. These figures not only highlight current adoption levels but also provide insights into how green hydrogen will shape energy security, industrial competitiveness, and climate goals in the coming decade.

This article explores the global market size of green hydrogen in 2025, the sectors driving its demand, the policy and financial incentives fueling adoption, and the technological innovations lowering costs. It also examines regional trends, key challenges, and future projections, offering a strategic outlook on how green hydrogen is set to become a central pillar of the net-zero economy.

Understanding Green Hydrogen and Its Market Relevance

What Is Green Hydrogen? Definition and Production Pathways

Green hydrogen refers to hydrogen produced by splitting water using electrolyzers powered by renewables like wind and solar. In contrast, blue hydrogen is created from natural gas with carbon capture, while grey hydrogen is derived from fossil fuels without emissions controls.

Why Green Hydrogen Matters for Decarbonization Goals

With ambitions to reach net-zero emissions by mid-century, industries such as steel, heavy transport, and chemicals require low-carbon alternatives—making green hydrogen a strategic solution. Its versatility across power, industry, and transport underscores its importance.

Global Green Hydrogen Market Size in 2025

Market Valuation and Installed Capacity Worldwide

The global green hydrogen market in 2025 is valued at approximately USD 11.9 to 12.3 billion, reflecting rapid progress in project development and technology scaling. This growth is being fueled by the expansion of renewable energy capacity, falling electrolyzer costs, and the commissioning of gigawatt-scale facilities.

While conservative estimates place the valuation within this range, more optimistic forecasts suggest even higher figures, particularly if government subsidies, carbon pricing, and global trade frameworks accelerate adoption. Installed electrolyzer capacity worldwide is expected to exceed several gigawatts by the end of 2025, marking a significant leap from pilot-scale initiatives just a few years earlier.

Regional Breakdown: Europe, North America, Asia-Pacific, Middle East, and Africa

Europe currently leads the market, driven by its ambitious EU Hydrogen Strategy, stringent decarbonization mandates, and strong investment pipelines. North America, particularly the United States, is expanding rapidly under the Inflation Reduction Act (IRA) and newly established hydrogen hubs. However, the Asia-Pacific region is expected to post the fastest growth. Countries like Japan and South Korea are prioritizing hydrogen imports and fuel cell adoption, while Australia is emerging as a key exporter due to its abundant renewable resources.

In the Middle East, nations like Saudi Arabia and the UAE are pursuing mega-projects to position themselves as global suppliers. Meanwhile, Africa is beginning to attract international investment in green hydrogen, especially in countries like Namibia and Morocco, leveraging strong solar and wind potential.

Key Growth Sectors: Power, Transportation, Steel, and Chemicals

Demand for green hydrogen in 2025 spans multiple industries, with transportation representing the most advanced early-stage market. Fuel cell vehicles, hydrogen-powered trucks, and pilot projects in aviation and shipping are already demonstrating viability. Beyond mobility, industrial applications are set to dominate in the long term.

Steelmaking, cement production, and ammonia synthesis are increasingly adopting hydrogen as a low-carbon feedstock, while the power sector is exploring hydrogen for grid balancing, seasonal storage, and renewable integration. These sectors collectively create a strong foundation for sustained demand growth.

Market Share of Electrolyzer Technologies

Electrolyzer deployment is central to scaling green hydrogen production. In 2025, alkaline electrolyzers maintain the largest market share due to their maturity, scalability, and relatively low cost for large projects.

However, proton exchange membrane (PEM) electrolyzers are rapidly gaining ground, especially in decentralized, modular, and renewable-integrated applications where flexibility and efficiency are critical. Solid oxide electrolyzers (SOECs), though still in early stages, show promise for future efficiency gains and industrial coupling.

Growth Projections Beyond 2025

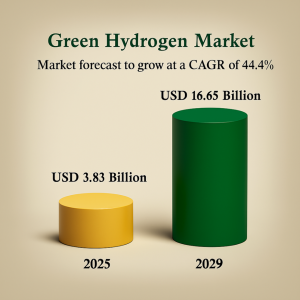

CAGR of the Global Green Hydrogen Market (2025–2030)

Between 2025 and 2030, the global green hydrogen market is projected to grow at a compound annual growth rate (CAGR) of 33% to 42%, depending on how quickly production costs decline and policies strengthen. This makes green hydrogen one of the fastest-growing segments within the broader clean energy landscape.

Long-Term Forecasts Toward 2035 and 2050

Looking further ahead, forecasts diverge significantly but highlight enormous potential. Some estimates project the market could surge from USD 7.7 billion in 2024 to nearly USD 328 billion by 2035, while others anticipate a valuation closer to USD 199 billion by 2034. This variability reflects differing assumptions on renewable energy costs, electrolyzer efficiency improvements, and global hydrogen trade development. By 2050, many analysts see green hydrogen as a mainstream commodity comparable to today’s oil and natural gas markets.

Role of Net-Zero and Paris Agreement Targets in Accelerating Growth

Global climate commitments are perhaps the strongest accelerators of green hydrogen adoption. Countries aligned with the Paris Agreement and net-zero roadmaps are investing heavily in hydrogen strategies to decarbonize hard-to-abate sectors. Incentives such as carbon pricing, tax credits, and direct subsidies are making green hydrogen more cost-competitive. As a result, hydrogen is evolving from niche pilot projects into a pillar of global energy security, industrial decarbonization, and economic competitiveness.

Policy and Regulatory Drivers of Market Expansion

International Climate Agreements and Hydrogen Roadmaps

Global climate agreements such as the Paris Accord, along with regional hydrogen roadmaps, are shaping clear targets for emission reductions and renewable integration. These frameworks create long-term certainty for investors and accelerate cross-border collaboration.

Subsidies, Tax Credits, and Green Financing Mechanisms

Financial incentives play a pivotal role in bridging the cost gap between green hydrogen and fossil-based alternatives. U.S. tax credits, Europe’s Green Deal recovery funds, and similar financing tools in Asia and the Middle East are lowering production costs, de-risking projects, and encouraging private-sector participation.

National Hydrogen Strategies

Governments worldwide—from Germany and Japan to India and Australia—are rolling out hydrogen strategies focused on scaling electrolyzer manufacturing, supporting pilot and commercial projects, and fostering domestic demand. These policies not only stimulate local markets but also aim to position countries as leaders in the emerging global hydrogen economy.

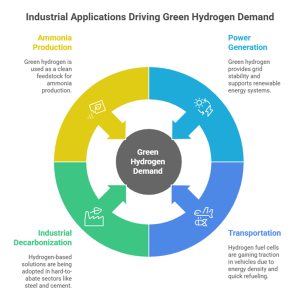

Industrial Applications Driving Demand

Green Hydrogen in Power Generation and Grid Balancing

Green hydrogen offers grid stability by acting as a long-term energy storage medium, supporting renewable-heavy electricity systems.

Hydrogen Fuel Cells in Transportation

Fuel-cell vehicles for cars, trucks, aviation, and shipping are gaining traction—partly due to hydrogen’s energy density and quick refueling potential.

Industrial Decarbonization: Steel, Cement, and Chemicals

Hard-to-abate sectors are investing in hydrogen-based solutions, such as hydrogen-based steelmaking and clean ammonia.

Role in Ammonia and Fertilizer Production

Green hydrogen is emerging as a clean feedstock for ammonia, helping decarbonize fertilizer and shipping fuels.

Key Market Players and Investment Trends

Leading Companies in Green Hydrogen Projects

Prominent players like Siemens Energy, Air Liquide, Nel ASA, Plug Power, Linde, and Air Products are leading deployments.

Major Green Hydrogen Projects Commissioned by 2025

Several gigawatt-scale electrolyzer facilities and consortium-backed hydrogen valleys have come online or are in the pipeline.

Investment Flows from Governments, Corporates, and Venture Capital

Billions in public and private capital are flowing into green hydrogen, with significant backing for electrolyzer manufacturing and integrated value-chain projects.

Public–Private Partnerships and Global Collaborations

Collaborative platforms between governments, technology firms, and utilities are accelerating deployment and cost reduction.

Technological Innovations and Cost Reductions

Advancements in Electrolyzer Efficiency and Scaling

Efficiency gains through better catalysts, membranes, and stack designs are steadily reducing costs.

Renewable Energy Integration: Wind, Solar, and Hybrid Systems

Countries pair electrolyzer installations with renewable power sources to improve cost-effectiveness and reduce carbon intensity.

Storage and Transport Challenges

Innovations in hydrogen carriers (like ammonia or LOHCs) and pipeline infrastructure are critical to scale.

Falling Levelized Cost of Hydrogen (LCOH): 2025 Benchmarks

As electrolyzer tech matures and renewable energy costs fall, green hydrogen’s LCOH is steadily declining—though exact figures vary based on location and electricity prices.

Challenges Hindering Market Growth

High Production Costs Compared to Fossil-Based Hydrogen

Green hydrogen currently commands premium pricing—often 1.5 to 6 times higher than grey hydrogen.

Infrastructure Gaps: Pipelines, Storage, and Refueling Stations

Insufficient infrastructure hampers distribution and end-user integration.

Policy Fragmentation and Lack of Global Standards

Divergent regulatory frameworks across countries slow cross-border trade and standardization.

Competition with Other Clean Energy Alternatives

Green hydrogen must compete with electrification, biofuels, and synthetic alternatives depending on sector-specific viability.

Regional Market Insights and Case Studies

Europe: Hydrogen Backbone and RePowerEU

Europe leads in both revenue and developed green hydrogen infrastructure, supported by cohesive policies.

United States: IRA Incentives and Hydrogen Hubs

Federal incentives and regional hub development are positioning the U.S. for accelerated production and consumption.

Asia-Pacific: Japan and South Korea’s Hydrogen Economy Push

Asia-Pacific is leading in growth trajectory—supported by aggressive national targets and industry innovation.

Middle East: Saudi Arabia and UAE Leading Mega-Projects

Massive renewable energy and electrolyzer complexes are under development to export green hydrogen and derivatives.

Emerging Economies: India, Brazil, and Africa

Investments in dedicated hydrogen materials manufacturing, gigafactories, and pilot-use cases are gaining momentum.

Measuring the Impact of Green Hydrogen Adoption

CO₂ Emissions Reduction Potential by 2030 and 2050

Widespread adoption of green hydrogen could prevent billions of tonnes of CO₂ emissions, particularly in carbon-intensive sectors such as steelmaking, heavy transport, and grid balancing. By 2050, its contribution could be pivotal in achieving net-zero targets.

Job Creation and Economic Benefits

The expansion of green hydrogen infrastructure is set to generate thousands of jobs across the value chain—from electrolyzer manufacturing and renewable energy integration to construction, operations, and maintenance. This growth also stimulates regional economies and attracts global investment.

Lifecycle Assessments: Comparing Green Hydrogen to Fossil Fuels

Compared to grey or blue hydrogen, green hydrogen produced with renewable energy offers a drastic reduction in lifecycle emissions. This makes it one of the most sustainable options for industries under pressure to decarbonize.

Indicators for Market Success

Progress is increasingly measured through metrics such as installed electrolyzer capacity, reductions in the levelized cost of hydrogen (LCOH), alignment with government policies, and the rise of international hydrogen trade flows. These benchmarks help track the sector’s shift from pilot projects to commercial scale.

Future Outlook for Green Hydrogen

Next-Generation Technologies: Solid Oxide Cells & Modular Electrolyzers

Emerging pathways like SOECs and stack modularity promise enhanced efficiency and flexible deployment.

Integration with AI, IoT, and Smart Grids

Smart systems are enabling predictive maintenance, performance optimization, and cost transparency.

Global Trade Outlook: Hydrogen as a Commodity

Hydrogen is being positioned as a new global energy commodity—reshaping trade dynamics and energy geopolitics.

Vision 2030 and Beyond

With market estimates approaching up to USD 328 billion by 2035, green hydrogen is on track to become a central driver of the clean energy economy—beyond a visionary concept to a strategic core energy asset.

FAQs on Green Hydrogen Market Size and Growth

What is the global market size of green hydrogen in 2025?

Estimates vary between USD 11.9 and 12.3 billion, depending on assumptions and methodologies.

Which region is leading in green hydrogen production?

Europe leads in current deployment, while Asia-Pacific is the fastest-growing region.

How fast is the market expected to grow by 2030?

Forecasted CAGRs range between 33% to 42%, reaching anywhere from USD 23 billion to USD 60 billion by 2030.

What industries are driving the largest demand?

Transportation, power systems, steel production, and chemical manufacturing are top demand drivers.

How much does green hydrogen cost in 2025 compared to fossil fuels?

Cost remains higher—often up to six times more—though declines are projected as technologies scale.

What government policies are supporting adoption?

Policies include hydrogen roadmaps, subsidies, tax incentives, and carbon credit schemes.

Can green hydrogen completely replace fossil fuels by 2050?

While not complete replacement, it can significantly decarbonize several hard-to-electrify sectors, assuming infrastructure and economics align.

What are the biggest infrastructure challenges?

Major gaps include pipelines, storage, distribution networks, and refueling infrastructure.

Conclusion

By 2025, green hydrogen is poised at the center of a structural energy transformation—laid out by robust market growth, technology advances, and policy momentum. Projections of up to USD 328 billion by 2035 underscore its transformative potential. To realize this vision, coordinated investment, regulatory frameworks, and innovation are essential. Whether you’re a student, researcher, or industry decision-maker—green hydrogen is a dynamic, data-driven opportunity and strategic frontier in clean energy.

Read More on Hydrogen Fuels….

Resources: